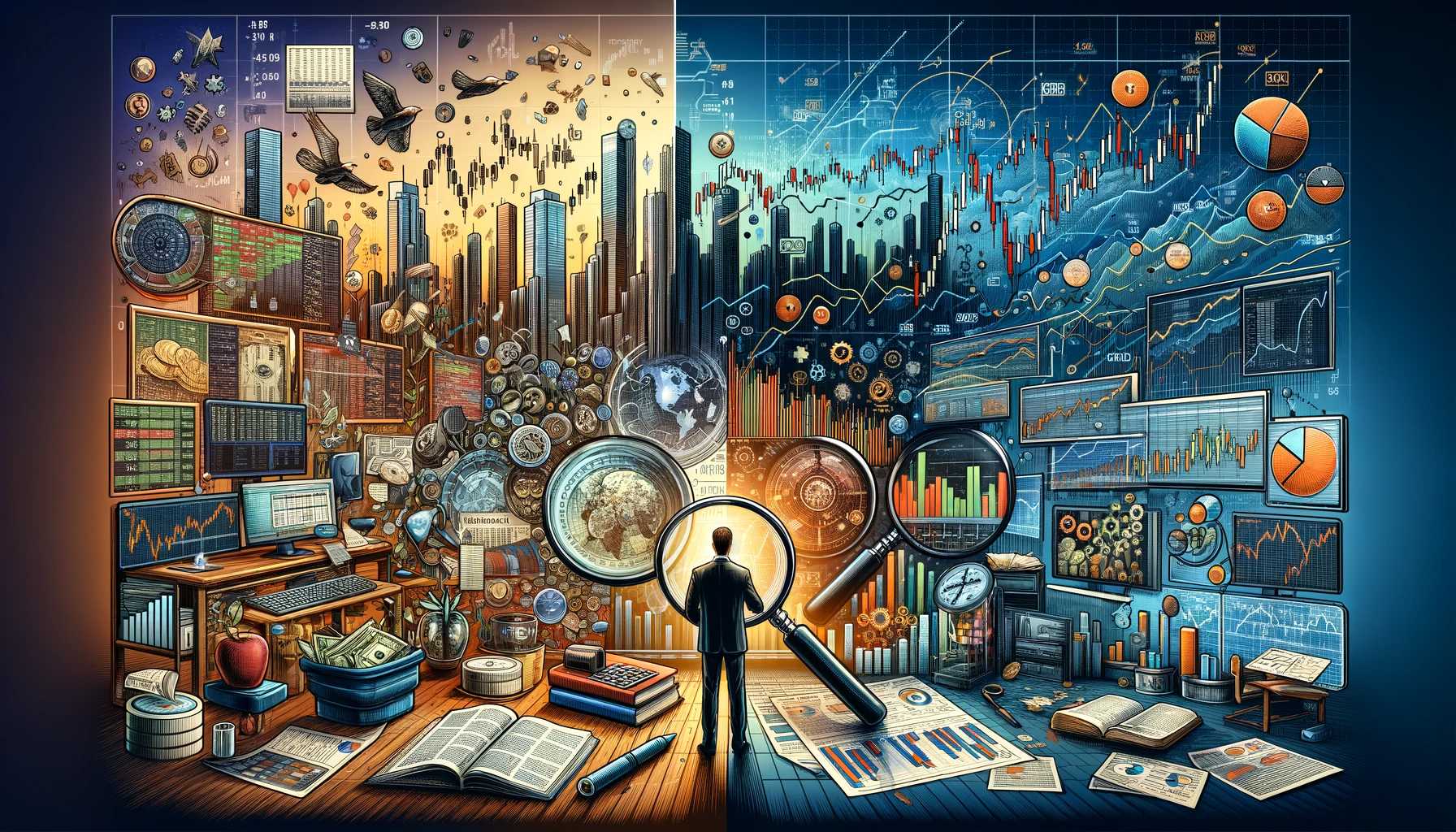

Decoding the Stock Market: Unveiling the Mysteries of Fundamental vs. Technical Analysis

Investing in stocks can be an exciting journey towards building wealth and achieving financial goals. However, navigating the ever-changing stock market can feel like deciphering an ancient language. Fear not, intrepid investor! Today, we'll delve into two fundamental approaches to stock analysis: fundamental analysis and technical analysis.

Fundamental Analysis: Digging Deep into the Company's Core

Imagine you're buying a used car. You wouldn't just look at the paint job and shiny rims, right? You'd check the engine, the mileage, and the overall condition. Similarly, fundamental analysis focuses on the intrinsic value of a company by examining its financial health, management, and industry trends. It's like peering under the hood of a company to understand its true potential.

Here are some key aspects of fundamental analysis:

- Financial Statements: These reports, like the income statement and balance sheet, reveal a company's profitability, solvency, and overall financial health. Analyzing these statements helps assess the company's financial stability and future growth potential.

- Management: The quality of a company's leadership team plays a crucial role in its success. Evaluating the experience, track record, and vision of the management team can provide insights into the company's future direction.

- Industry Analysis: Understanding the industry dynamics, growth prospects, and competitive landscape is essential. A thriving industry with strong tailwinds can benefit the companies within it, while a declining industry might pose challenges.

Technical Analysis: Reading the Tea Leaves of the Market

While fundamental analysis focuses on the company itself, technical analysis takes a different approach. It focuses on historical price movements, trading volume, and technical indicators to identify potential trading opportunities. Think of it like reading tea leaves or analyzing weather patterns to predict future market behavior.

Here are some key aspects of technical analysis:

- Charts and Indicators: Technical analysts utilize various charts and technical indicators like moving averages, relative strength index (RSI), and MACD to identify trends, support and resistance levels, and potential buying or selling signals.

- Price Patterns: Identifying recurring price patterns in historical data can help predict future price movements, although past performance is not always indicative of future results.

- Market Sentiment: Gauging investor sentiment, whether bullish or bearish, can provide insights into the overall market psychology and potential price movements.

Choosing Your Weapon: When to Use Each Approach

So, which approach is better? The truth is, there's no single "right" answer. Both fundamental and technical analysis have their strengths and weaknesses, and the best approach often involves combining elements of both:

- Fundamental analysis is ideal for long-term investors who focus on the company's long-term potential and value. It helps identify companies with strong fundamentals that are poised for sustainable growth over time.

- Technical analysis is often favored by short-term traders who aim to capitalize on short-term price movements and market fluctuations. It can be used to identify potential entry and exit points for trades based on technical signals and chart patterns.

Remember, investing is not an exact science. Both fundamental and technical analysis are tools that can help you make informed investment decisions, but they are not guarantees of success. Always conduct thorough research, understand your risk tolerance, and never invest more than you can afford to lose.

Investing for the Future: Beyond the Basics

As you embark on your investment journey, remember these essential tips:

- Diversify your portfolio: Don't put all your eggs in one basket! Spread your investments across different asset classes and companies to mitigate risk.

- Stay informed: Keep yourself updated on market trends, company news, and economic developments.

- Seek professional guidance: Consider consulting a financial advisor for personalized advice tailored to your specific financial goals and risk tolerance.

Investing can be a rewarding experience, but it requires knowledge, discipline, and a healthy dose of caution. By understanding the fundamentals of both fundamental and technical analysis, you can equip yourself with the tools you need to navigate the stock market with greater confidence and make informed investment decisions for your future.

Beyond the Basics: Advanced Techniques and Avoiding Common Pitfalls

While fundamental and technical analysis provide valuable frameworks, the investing landscape is multifaceted. Here are some advanced techniques and common pitfalls to consider:

Advanced Techniques:

Value Investing: This strategy involves identifying undervalued stocks with strong fundamentals that are trading below their intrinsic value. By investing in such companies, you potentially benefit when the market recognizes their true worth and the stock price rises.

Growth Investing: This approach focuses on companies with high growth potential, even if they are not yet profitable. These companies often operate in emerging industries or have disruptive technologies, offering the potential for significant future returns.

Quantitative Analysis: This method utilizes mathematical models and statistical techniques to analyze vast amounts of data and identify investment opportunities. While powerful, it requires significant knowledge and expertise in quantitative modeling and data analysis.

Avoiding Common Pitfalls:

- Chasing Hot Stocks: Don't blindly follow the herd and invest in stocks solely based on hype or short-term trends. Conduct your own research and understand the company's fundamentals before investing.

- Emotional Investing: Letting emotions like fear or greed dictate your investment decisions can lead to impulsive choices and costly mistakes. Maintain a rational and disciplined approach based on your investment plan.

- Overconfidence: Avoid the trap of believing you can consistently outperform the market. Market fluctuations are inherent, and even the most experienced investors face setbacks.

- Neglecting Diversification: Spreading your investments across different asset classes and industries helps mitigate risk and protect your portfolio from market downturns.

Remember: Investing is a lifelong journey, and continuous learning is crucial. Stay updated on evolving market trends, new investment strategies, and potential risks. Seek guidance from experienced investors or financial advisors when needed.

The Final Word: Investing for a Brighter Future

By understanding the fundamentals of both fundamental and technical analysis, coupled with a blend of advanced techniques and awareness of common pitfalls, you can equip yourself for success in the dynamic world of stock investment. Remember, investing is not a get-rich-quick scheme; it requires patience, discipline, and a commitment to continuous learning. Embrace the journey, make informed decisions, and pave the way towards a future filled with financial security and the potential to achieve your long-term goals.