The Basic of Portfolio Diversification

Meaning of Diversification?

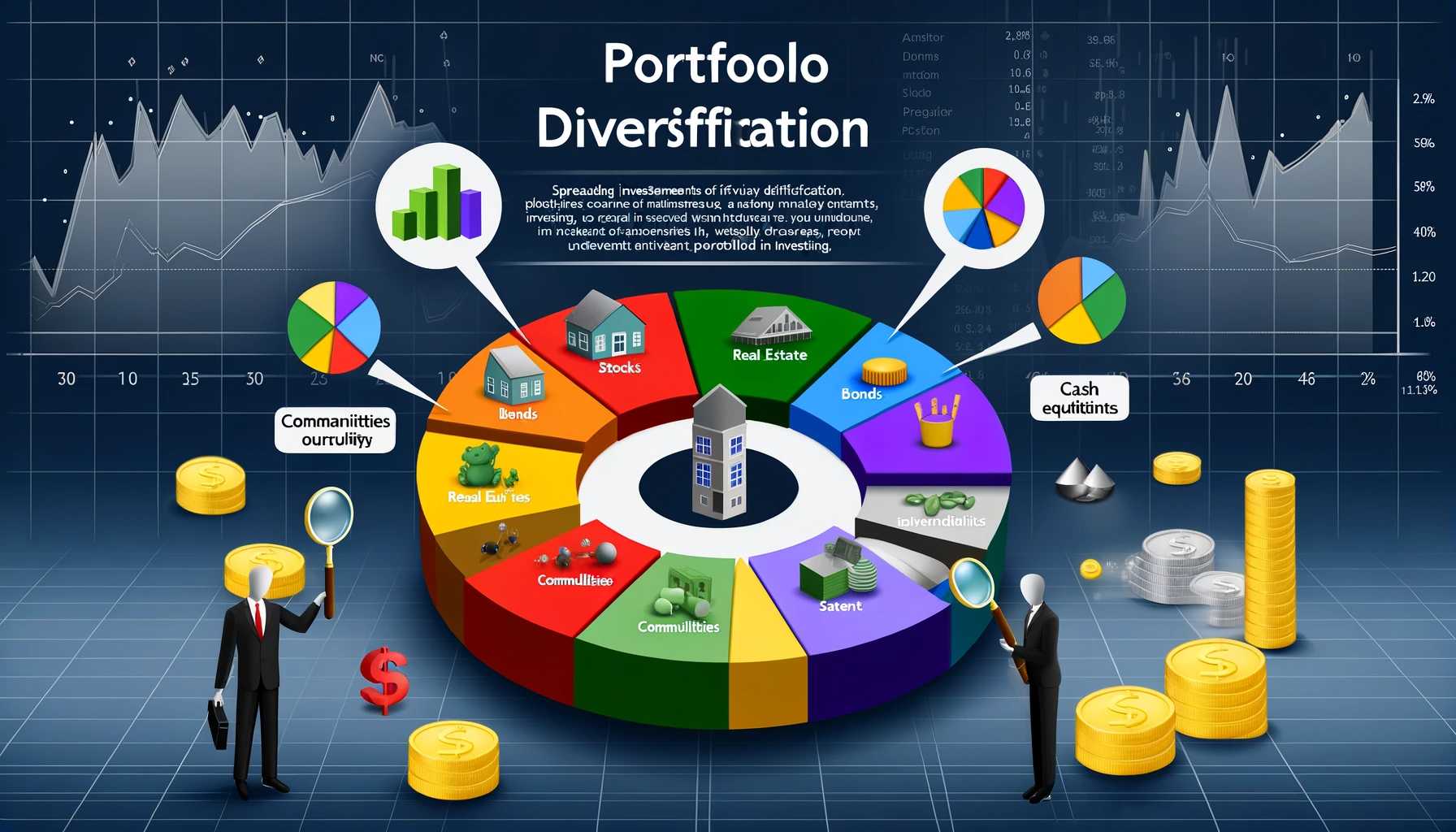

Diversification is the process of spreading your resources across a variety of different investments or activities. This is done to reduce risk and to ensure that you’re not putting all your eggs in one basket. In order words diversification is about not putting all of your money or efforts into one particular thing. It’s a strategy that is used in finance, business, and even in life more generally.

A portfolio's mix of different investments is created through the risk management technique known as diversification. To reduce exposure to any one asset or risk, a diversified portfolio combines a variety of unique asset classes and investment vehicles.

This strategy is based on the idea that a diverse portfolio would generally provide better long-term returns and reduce the risk associated with any one holding or securities.

What to know about Diversification

The most economical degree of risk reduction can be achieved by keeping a well-diversified portfolio of 25 to 30 companies, according to studies and mathematical models. Additional diversification benefits can be obtained by investing in more securities, however these benefits reduce over time.

The goal of diversification is to mitigate unsystematic risk occurrences in a portfolio by balancing out the gains and losses from individual investments. Only when the assets in the portfolio are not fully correlated that is, when they react to market movements differently, frequently in opposition to one another does diversity yield its benefits.

Strategies of Diversification

As investors consider ways to diversify their holdings, there are dozens of strategies to implement. Many of the methods below can be combined to enhance the level of diversification within a single portfolio.

- Asset allocation

This involve spreading your investments across different assets classes, such as stocks, bonds, and cash. Fund managers and investors often diversify their investments across asset classes and determine what percentages of the portfolio to allocate to each. Each asset class has a different, unique set of risks and opportunities. Classes can include:

- Stocks: Shares or equity in a publicly traded company

- Bonds: Government and corporate fixed-income debt instruments

- Real estate: Land, buildings, natural resources, agriculture, livestock, and water and mineral deposits

- Exchange-traded funds (ETFs): A marketable basket of securities that follow an index, commodity, or sector

- Commodities: Basic raw materials necessary for the production of other products or services

- Cash and short-term cash-equivalents (CCE): Treasury bills, certificate of deposit (CD), money market vehicles, and other short-term, low-risk investments

The theory holds that what may negatively impact one asset class may benefit another. For example, rising interest rates may result in increases in rents for real estates or increases in prices for commodities.

Industries / Sectors

In terms of diversifying by industries and sectors, this can be done by investing in a range of different industries, such as technology, health care, and financial services. This helps to ensure that you’re not relying too heavily on any one industry.

Take the CHIPS and Science Act of 2022, for instance.1. Though some businesses are more impacted than others, this legislation affects several industries. The financial services industry may experience milder, lingering effects, but semiconductor manufacturers will be heavily affected.

Investors can achieve industry diversification by combining assets that could balance out disparate companies. Think about two popular forms of entertainment, for instance: digital streaming and vacation. Investing in digital streaming services (which benefit from increased shutdowns) is one way that investors may protect themselves against the possibility of future pandemic effects. Simultaneously, they might think about investing in airlines (which would benefit from fewer shutdowns). Theoretically, the combined risk of these two unconnected industries may be reduced.

Cyclical and Defensive Industries

Cyclical industries are those that are sensitive to changes in the economy, such as the automotive industry. Defensive industries are those that are less sensitive to economic changes, such as utilities and consumer staples.

Corporate Lifecycle Stages (Growth vs. Value)

Public equities tend to be broken into two categories: growth stocks and value stocks. Growth stocks are stocks that are expected to grow at a faster rate than the overall market. These stocks are often associated with companies in the early stages of the cooperate life cycle. Value stocks are stocks that’s trending at a lower price than what is expected to be worth in the future. These stocks are often associated with mature companies that have established business and steady profits. While value stocks may not have the same potential for growth as growth stocks, they can still be a good investment for those who are looking for a relatively safe investments with a decent return.

Growth stocks tend to be more risky than any other type of stocks, but also have the potential for high returns. When investing in growth stocks, it’s important to do your research and understand the risks involved.

One of the benefits of value stocks is that they tend to be less volatile than growth stocks. This means that they’re less likely to experience big swings in price, which can make them a good choice for investors who are looking for a bit of stability. By diversifying into both, an investor would capitalize on the future potential of some companies while also recognizing the existing benefits of others.

Market Capitalizations (Large vs. Small)

Market capitalization, or market cap for short, is another important concept to understand when it comes to stocks. Market cap is calculated by multiplying the number of understanding shares by the current share price. This gives you the total dollar value of the company.

Stocks are often categorized by their market cap, with small-cap stocks being the smallest and mega-cap stocks being the largest. Understanding market cap can help you make more informed investment decisions.

Risk Profiles

Investors have the option to select the security's underlying risk profile in practically every asset class. Take fixed-income securities, for instance. An investor has the option to purchase bonds from the world's most reputable governments or from almost bankrupt private businesses seeking emergency funding. Based on the issuer, credit rating, operational outlook, and current debt level, there are significant variations between a numbers of 10-year bonds.

This also applies to other categories of investments. Riskier real estate development projects might yield higher returns than already-established functioning properties. Conversely, compared to coins or tokens with smaller market capitalization, cryptocurrencies with longer histories and higher levels of adoption—like Bitcoin carry less risk.

Diversification may not be the best strategy for investors wanting to maximize their returns, as different investors have different risk tolerance and investment goals. However, many investors use a strategy known as asset allocation. This involves spreading your investments across different asset classes.

Maturity Lengths

Different term lengths have an impact on risk profiles specifically for fixed-income securities like bonds. Generally speaking, the longer the maturity, the greater the risk of interest rate fluctuations impacting the bond's price. Short-term bonds typically offer lower interest rates but are also less affected by uncertainty in future yield curves. Investors who are more comfortable with risk may want to add longer term bonds that tend to pay higher degrees of interest. Maturity length is also common in other asset classes. For example, short-term lease agreements for residential properties (i.e., up to one year) and long-term lease agreements for commercial properties.

Physical Locations (Foreign vs. Domestic)

Investing in foreign securities can provide investors with even more diversification benefits. For instance, Japan's economy could not be impacted in the same manner by factors that are hurting the US economy. Consequently, an investor who owns Japanese stocks has a little buffer against losses during a downturn in the US economy.

Alternatively, diversifying among developed and emerging nations may offer a higher potential gain (with correspondingly higher levels of risk). Take Pakistan's current status as a participant in the frontier market (downgraded from an emerging market participant recently). If investors are prepared to assume greater levels of risk, they might wish to think about the higher growth potential of smaller, less developed markets like Pakistan.

Tangibility

Tangibility is an important factor when it comes to investing. Tangibility refers to the physical nature of an investment, such as whether it’s tangible asset like real estate or an intangibly asset like a stock. Tangibly assets are considered less risky because they have an intrinsic value that can be measured. Intangible assets, on the other hand, don’t have a physical value and are more susceptible to market fluctuations.

There are also unique risks specific to tangible assets. Real property can be vandalized, physically stolen, damaged by natural conditions, or become obsolete. Real assets may also require storage, insurance, or security costs to carry. Though the revenue stream differs from financial instruments, the input costs to protect tangible assets are also different.

Across Platforms

Diversification across platforms, also known as “assets class diversification”. Is another key strategy for investors. This involves spreading your investments across different types of platform, such as online brokerages, traditional brokerages, and robo-advisors. By doing this, you can gain access to a wider range of investments and potentially improve your returns.

For example, you might use an online brokerage to trade stocks, a traditional brokerage to invest in mutual funds, and a robo-advisor to invest in ETFs.

You might consider diversifying your investments across countries as well. This is known as “geographic diversification”. By investing in different countries, you can take advantage of different economic environments and potentially earn higher returns. Diversifying across countries also helps to reduce the risk of your portfolio being affected by a single country’s economic conditions